You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Running Bear's September 2022 Coffee Shop

- Thread starter bnsf971

- Start date

- Status

- Not open for further replies.

chadbag

Well-Known Member

Spent the late morning running the mini-excavator. I am definitely a lot slower getting results than the guys who know what they are doing. Went to lunch and came back with my son and a foreman type and his helper from the plumber was there to plan in more detail what they need to do. After confirming stuff with me etc. he took over the mini-excavator. My son and I took our shovels, pick, and digging bar (the 6' pry bar with a flat end and pointy end used for digging holes and prying out rocks) and we started to manually dig the trench inside the cold storage (where the excavator doesn't go). We got that and my son had to leave. I was working under the footing to match up to the trench the guy had dug with the excavator. Had to use the men's room and so drove home (1 mile or less) to our currrent house and ended up being there 45 min as I had to pay an online invoice so some of the hydronic radiant heat stuff needed in the basement can get shipped and a few other things and a quick snack. When I got back the other guys had gone. I finished going under the footing (30+ inches wide), attacking it from both ends, though it needs to be cleaned out. I'll let them tell me how big it actually needs to be.

Then I came home about 6:45pm.

They ended up with the mini excavator in the rear corner. Not sure what they plan on doing -- not all the trench work is done. But it needs to be against the front wall by 3pm tomorrow (Sep 1) as the crane will be here to hoist it back out and the rental place is picking it up around 4pm or later. I'll let them figure it out tomorrow. I think they are trying to get all the pipes in for the drainage rough-in etc tomorrow. They work 4x10 a week and have a commercial job starting Monday. That is why I was helping with the digging etc, which I had not planned. They were behind on some other commercial and were trying to squeeze me in this week and couldn't free up enough guys to manually dig everything. (Which would probably cost a fortune in labor).

The soil is very rocky. A lot of softer sandstone type rocks I think plus some granite types. I pulled more rocks out than soil it feels like while we were hand digging inside the cold storage.

I just want this house project to be over with!

Then I came home about 6:45pm.

They ended up with the mini excavator in the rear corner. Not sure what they plan on doing -- not all the trench work is done. But it needs to be against the front wall by 3pm tomorrow (Sep 1) as the crane will be here to hoist it back out and the rental place is picking it up around 4pm or later. I'll let them figure it out tomorrow. I think they are trying to get all the pipes in for the drainage rough-in etc tomorrow. They work 4x10 a week and have a commercial job starting Monday. That is why I was helping with the digging etc, which I had not planned. They were behind on some other commercial and were trying to squeeze me in this week and couldn't free up enough guys to manually dig everything. (Which would probably cost a fortune in labor).

The soil is very rocky. A lot of softer sandstone type rocks I think plus some granite types. I pulled more rocks out than soil it feels like while we were hand digging inside the cold storage.

I just want this house project to be over with!

CambriaArea51

Well-Known Member

A little early, I guess I'll have a nightcap Flo.

Got some grain cars coming next week. Gotta stock up train season soon.

Got some grain cars coming next week. Gotta stock up train season soon.

D&J RailRoad

Professor of HO

wow, September already.

Flo might get audited.

Flo might get audited.

Patrick

Alien Attitude.

Morning all,

Coffee and a blue plate this morning, thanks Flo. Was a productive day yesterday, may need to do a drive more often. I used to be a road tech years ago, before a flood made the need to be home a no brainer.. I hate the auto correct on this dang phone. Tech thinks it knows better than me what I want to say...

Currently 63° and clear, high today of 95°.

BBL

Coffee and a blue plate this morning, thanks Flo. Was a productive day yesterday, may need to do a drive more often. I used to be a road tech years ago, before a flood made the need to be home a no brainer.. I hate the auto correct on this dang phone. Tech thinks it knows better than me what I want to say...

Currently 63° and clear, high today of 95°.

BBL

OBTC 1909

Well-Known Member

Good morning all! Happy September. 55 headed for 84. Should be another beautiful day.

After work, we're taking the two younger grand kids to meet up with our oldest granddaughter for dinner. Should be a good time. Haven't seen the oldest in quite a while due to her work schedule.

Spent yesterday evening working on school work. I had done an outline for my first speech for speech class and decided I wasn't happy with it, so I re-did it last night. Still have a little math homework to get done.

That's about it. Hope you all have a great day!

After work, we're taking the two younger grand kids to meet up with our oldest granddaughter for dinner. Should be a good time. Haven't seen the oldest in quite a while due to her work schedule.

Spent yesterday evening working on school work. I had done an outline for my first speech for speech class and decided I wasn't happy with it, so I re-did it last night. Still have a little math homework to get done.

That's about it. Hope you all have a great day!

Alan: Having dealt with the IRS, I'm inclined to agree with you that you probably will never see an agent face to face. The unnerving part of this is that the intent of these new employees is to go after non compliance from affluent types, (per the Times, the over $400K club). Again according to the NY Times, the target for compliance is more likely to employ tax attorneys and accountants who "may" overwhelm these agents. The pressure to get tangible results will force these people to seek out non compliance in earners of less than $400K, who are less likely to employ professional help, and are more likely to acquiesce to IRS inquires...

Boris,

That's what people who want to frighten you in order to get your vote are saying. Unfortunately what you're worried about here is what's already happening because of the short staffing. Because they're short staffed, they're focusing on the easy ones...us. I was the focus of an IRS audit once, due to fraud on the part of a former employer, and nope, it wasn't fun. They are a determined bunch, but reasonable, and I was able to show them the error of their ways in the end. The real way not to have to worry about this is: Just pay your taxes and don't try and flim

- flam the government. They'll take it personal! There's a pretty good breakdown of where all that money is going here: https://www.npr.org/2022/08/14/1117...s-dodgers-inflation-reduction-act-enforcement

There's a pretty good breakdown of where all that money is going here: https://www.npr.org/2022/08/14/1117...s-dodgers-inflation-reduction-act-enforcement

Boris,

That's what people who want to frighten you in order to get your vote are saying. Unfortunately what you're worried about here is what's already happening because of the short staffing. Because they're short staffed, they're focusing on the easy ones...us. I was the focus of an IRS audit once, due to fraud on the part of a former employer, and nope, it wasn't fun. They are a determined bunch, but reasonable, and I was able to show them the error of their ways in the end. The real way not to have to worry about this is: Just pay your taxes and don't try and flim

- flam the government. They'll take it personal!

santafewillie

Same Ol' Buzzard

Good Morning All. Partly cloudy and 73°, rain is still in the forecast for today. Should reach 85° again today if it remains cloudy. Warmer if the sun appears. The rain yesterday came close but just not here. Rained across the road about 50 yards away for a short while. Washed those cows who didn't need it after the storms Monday night. The NWS has taken the rain out of the forecast for some of the days next week.

Managed to mow the north and west sides of the yard behind the train shed, also got the area between the train shed and the garden. What a beating that part was. Couldn't start until after lunch because of the dew and the area between the train shed and my pond was over 2' tall.

No mowing today as it is Thursday, the weekly grocery trek. I'm not sure where else we might be headed, or even if my wife is going along.

Thanks for all of the likes and comments regarding my layout upgrade progress; Smudge, Tom O, Karl, Sherrel, Guy, Christian, Joe, Chad, Dave B, Hughie, Chet, Patrick, Louis, Curt, Rick.

Out in the train shed yesterday, I worked on two fronts, and ran some trains.

The first was a simple but time consuming task of painting a cloud on the backdrop to break up the monotony.

Next, I went across the street to the large bank building and completed the parking area and the space between the rear and the track.

Some touch up is needed and stripes in the parking lot. This is as far as I plan to go at this time, other than minor enhancements to what I have done.

Tom O - 3 miles in 51 minutes is quite brisk. Good for you. When I walk to the mailbox and back, 2.5 miles, that usually takes me 60 minutes, although a simple mile only takes 20 minutes.

Chet - No boat yet! It has been very dry here. The 2.2" Monday night barely had runoff. It all soaked in. And that was after an inch or so a week before. While I have posted pictures before of my yard under water, it generally all drains in two hours or so. It should drain faster now that the county fixed the roadside ditches.

Odd that insurance works differently from state to state. Medicare/Blue Cross paid my wife's first knee replacement rehab at a clinic in full. She chose to do the second one at home with my assistance. The replacement of a replacement was in house with a traveling therapist, again fully paid for.

Sherrel and others - I was reminded of some posts earlier in the week when the government of Kalifornia decided to outlaw the sale of gasoline vehicles by 2035. Then yesterday the utility authority told everyone not to charge their cars because the electric system was strained! There's just 400,000 EV's out there now, and 15,000,000 gasoline powered vehicles. What's going to happen when there's 16 million EV's???

Everybody have a wonderful day.

Managed to mow the north and west sides of the yard behind the train shed, also got the area between the train shed and the garden. What a beating that part was. Couldn't start until after lunch because of the dew and the area between the train shed and my pond was over 2' tall.

No mowing today as it is Thursday, the weekly grocery trek. I'm not sure where else we might be headed, or even if my wife is going along.

Thanks for all of the likes and comments regarding my layout upgrade progress; Smudge, Tom O, Karl, Sherrel, Guy, Christian, Joe, Chad, Dave B, Hughie, Chet, Patrick, Louis, Curt, Rick.

Out in the train shed yesterday, I worked on two fronts, and ran some trains.

The first was a simple but time consuming task of painting a cloud on the backdrop to break up the monotony.

Next, I went across the street to the large bank building and completed the parking area and the space between the rear and the track.

Some touch up is needed and stripes in the parking lot. This is as far as I plan to go at this time, other than minor enhancements to what I have done.

Tom O - 3 miles in 51 minutes is quite brisk. Good for you. When I walk to the mailbox and back, 2.5 miles, that usually takes me 60 minutes, although a simple mile only takes 20 minutes.

Chet - No boat yet! It has been very dry here. The 2.2" Monday night barely had runoff. It all soaked in. And that was after an inch or so a week before. While I have posted pictures before of my yard under water, it generally all drains in two hours or so. It should drain faster now that the county fixed the roadside ditches.

Odd that insurance works differently from state to state. Medicare/Blue Cross paid my wife's first knee replacement rehab at a clinic in full. She chose to do the second one at home with my assistance. The replacement of a replacement was in house with a traveling therapist, again fully paid for.

Sherrel and others - I was reminded of some posts earlier in the week when the government of Kalifornia decided to outlaw the sale of gasoline vehicles by 2035. Then yesterday the utility authority told everyone not to charge their cars because the electric system was strained! There's just 400,000 EV's out there now, and 15,000,000 gasoline powered vehicles. What's going to happen when there's 16 million EV's???

Everybody have a wonderful day.

D&J RailRoad

Professor of HO

I would think the lucrative targets of the IRS agents would be the little guy whose wife sold some items on eBay years ago and didn't pay the income tax on them. It adds up. The taxes due, the fines for late filing, the penalties for no paying, then, if they decide you are attempting to evade tax, you will be charged with tax evasion and the penalty will suddenly become well worth the effort by the IRS agent.

TLOC

Well-Known Member

Good morning Crew from the beautiful clear skies of So. Central Wisconsin. 63f degrees now maybe 87 later. I love September because the weather is usually the best Wisconsin has to offer, the color change in nature can be beautiful and September had many firsts and super memories for me. First alcoholic drink 52 years ago on the 2nd, I was still 17. I was invited into the club room at the private country club I worked at as a going away party by many of the members. A gin and tonic and no clue how I got home that night. Spent most of the next morning with my dad laughing at me while I nursed a massive headache. I was headed off that afternoon for college as a Freshman at Marquette. Lots of firsts during the rest of the month. Such great memories.

Heading to Racine today and then lunch at the Milwaukee Ale House that closes this month on the 11th. . Terry and I have had many a good time over the last 25 years here. Before we get to Racine we will stop at Hiawatha Hobbies that is just off an exit on the way. I have a hour of time to spend in there and I have a list. After lunch we will take the friend we picked up in Racine back to her boat in the Kenosha marina and we will take the scenic route back home.

enjoy the day

Heading to Racine today and then lunch at the Milwaukee Ale House that closes this month on the 11th. . Terry and I have had many a good time over the last 25 years here. Before we get to Racine we will stop at Hiawatha Hobbies that is just off an exit on the way. I have a hour of time to spend in there and I have a list. After lunch we will take the friend we picked up in Racine back to her boat in the Kenosha marina and we will take the scenic route back home.

enjoy the day

Depends. Scenario 1: Your wife sold a few dresses and a dinette set on e-bay and didn't report it. Unlikely they'll bother with you. No return on investment. Scenario 2: Your wife sells $50-60K worth of stuff a year on e-Bay that she picks up at garage sales, makes a tidy profit, and doesn't report it. Unfortunately she uses PayPal to accept payment. You may have a problem, because she's actually running a small business! When I sold airbrushes at trains shows I had to deal with this, plus state taxes wherever the shows were. They will come after you, but what you usually get is a bill, not a lawsuit. I had to cancel a show once, and because I had filled out the state tax paperwork, I got a bill based on what they assumed I made in their state that year and a penalty. $60.00. A letter made it go away. This was state, not fed, but they work pretty much the same way.I would think the lucrative targets of the IRS agents would be the little guy whose wife sold some items on eBay years ago and didn't pay the income tax on them. It adds up. The taxes due, the fines for late filing, the penalties for no paying, then, if they decide you are attempting to evade tax, you will be charged with tax evasion and the penalty will suddenly become well worth the effort by the IRS agent.

D&J RailRoad

Professor of HO

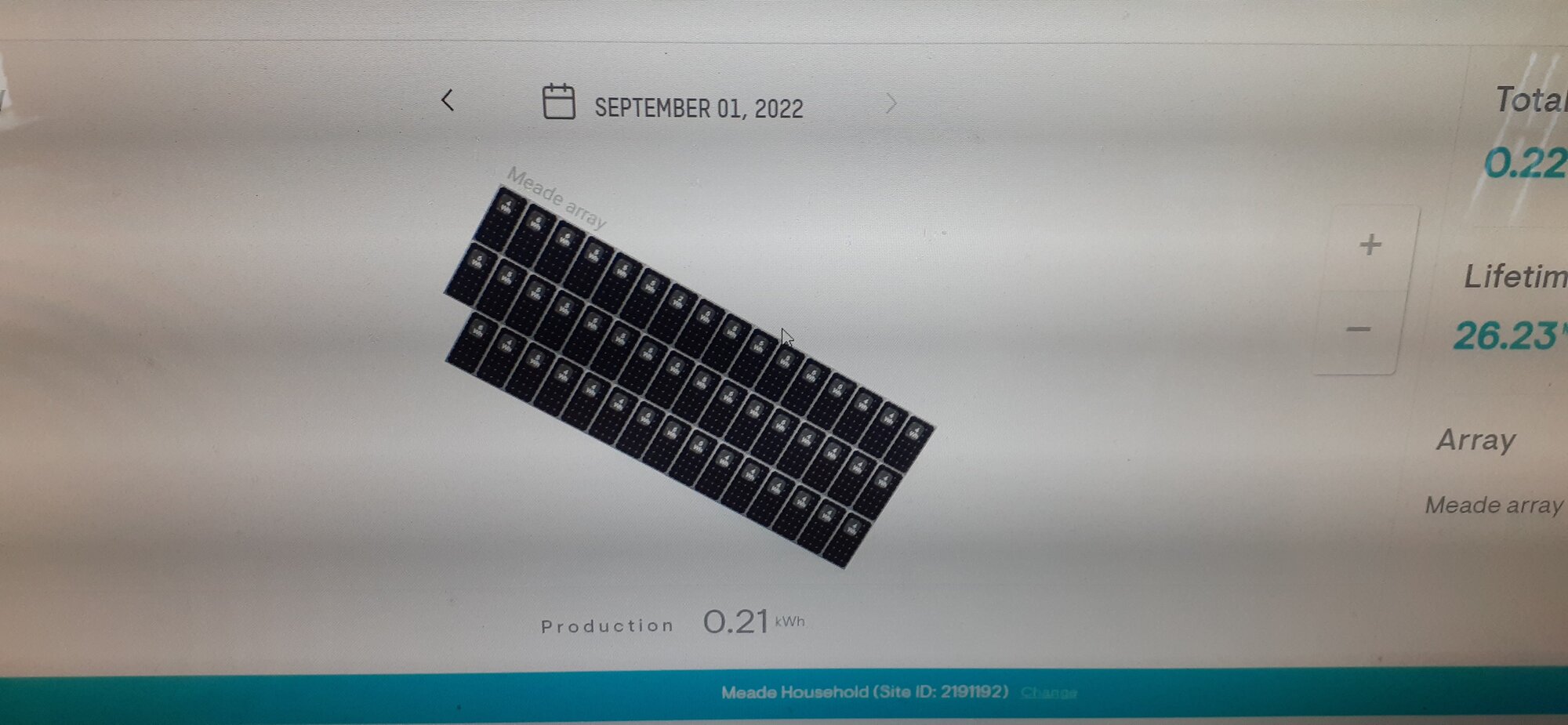

I have an app that I can view the performance of my solar panel array, panel by panel. This picture is before the sun is shining on it this morning so the panel output is at a minimal. Typically during the middle of the day each panel is reporting 1.4KW or so.

I noticed one of the panels was under performing by about 1/3 of the others. The panel design is actually three charging areas in each panel, so obviously one of those charging areas has gone bad somehow.

I reported this to my installer a couple days ago. They will be out here this morning to install a replacement pane.

Over on the right edge is some of the reporting data. This system has produced over 26 megawatts since a year ago April. I have a Net Zero meter on the house that reports to the electric company. It runs backward during the day when my excess power is feeding the grid and runs forward at night when I'm drawing from the grid. Right now, the meter shows about 9 MWs to the good. I just picked up my Tesla last week and have used about 200kWh of energy, all from the sun.

I noticed one of the panels was under performing by about 1/3 of the others. The panel design is actually three charging areas in each panel, so obviously one of those charging areas has gone bad somehow.

I reported this to my installer a couple days ago. They will be out here this morning to install a replacement pane.

Over on the right edge is some of the reporting data. This system has produced over 26 megawatts since a year ago April. I have a Net Zero meter on the house that reports to the electric company. It runs backward during the day when my excess power is feeding the grid and runs forward at night when I'm drawing from the grid. Right now, the meter shows about 9 MWs to the good. I just picked up my Tesla last week and have used about 200kWh of energy, all from the sun.

ctclibby

Well-Known Member

I would think that the eBay sales would be at a loss, probably CL and FB too. On the other hand selling something bright, shiny and brand new could be an issue. If it is a "one of" you might be hanging your rear out there, if multiple you probably are in business which already has ways to reduce the tax liability. Well at least if you are honest about the whole thing. Still, smaller guys might just pay what the tax collector wants as that may be easier than coming up with a paper trail ( money trail also ) to show them.I would think the lucrative targets of the IRS agents would be the little guy whose wife sold some items on eBay years ago and didn't pay the income tax on them. It adds up. The taxes due, the fines for late filing, the penalties for no paying, then, if they decide you are attempting to evade tax, you will be charged with tax evasion and the penalty will suddenly become well worth the effort by the IRS agent.

D&J RailRoad

Professor of HO

What I'm sayin is the lucrative part for the IRS is the fine for the charge of Tax evasion. That might be 10s of thousands. Listen to the speech tonight and you should be able to put the picture together.Depends. Scenario 1: Your wife sold a few dresses and a dinette set on e-bay and didn't report it. Unlikely they'll bother with you. No return on investment. Scenario 2: Your wife sells $50-60K worth of stuff a year on e-Bay that she picks up at garage sales, makes a tidy profit, and doesn't report it. Unfortunately she uses PayPal to accept payment. You may have a problem, because she's actually running a small business! When I sold airbrushes at trains shows I had to deal with this, plus state taxes wherever the shows were. They will come after you, but what you usually get is a bill, not a lawsuit. I had to cancel a show once, and because I had filled out the state tax paperwork, I got a bill based on what they assumed I made in their state that year and a penalty. $60.00. A letter made it go away. This was state, not fed, but they work pretty much the same way.

How do they know what you've sold? Look on your ebay page and you will find the total sales. Match that up to what you reported on your tax return. Oh, IRS has access to that through ebay and you signed that away when you joined ebay. Gotcha.

ctclibby

Well-Known Member

1.4KW per panel - that a typo?I have an app that I can view the performance of my solar panel array, panel by panel. This picture is before the sun is shining on it this morning so the panel output is at a minimal. Typically during the middle of the day each panel is reporting 1.4KW or so.

I noticed one of the panels was under performing by about 1/3 of the others. The panel design is actually three charging areas in each panel, so obviously one of those charging areas has gone bad somehow.

I reported this to my installer a couple days ago. They will be out here this morning to install a replacement pane.

Over on the right edge is some of the reporting data. This system has produced over 26 megawatts since a year ago April. I have a Net Zero meter on the house that reports to the electric company. It runs backward during the day when my excess power is feeding the grid and runs forward at night when I'm drawing from the grid. Right now, the meter shows about 9 MWs to the good. I just picked up my Tesla last week and have used about 200kWh of energy, all from the sun.

View attachment 151031

Also, are you planning some sort of battery array? I am getting there although still in the "what if" and design stage.

Fine for tax evasion? Well if you're talking about the little guy, doubtful. If they see criminal intent , sure, but it's been my experience with them that they tend to give the little guy the benefit of the doubt and treat such things as a clerical error or a mistake on your part, and provide you with an adjusted payment, which you are free to discuss with them (I have) and it generally works out (it did). Bottom line advice: 1: Don't be a criminal. 2: Pay your taxes. Easy Peasy. Is it a perfect system? Nope. Show me one. As long as there are humans in the equation, that's not gonna happen, but unless you give them the impression that you're involved in some sort of skullduggery, or are demonstrating bad faith, its unlikely you're going to have any problems. That's been my experience after some 51 years in the workforce and five or so years as a small business owner.What I'm sayin is the lucrative part for the IRS is the fine for the charge of Tax evasion. That might be 10s of thousands. Listen to the speech tonight and you should be able to put the picture together.

How do they know what you've sold? Look on your ebay page and you will find the total sales. Match that up to what you reported on your tax return. Oh, IRS has access to that through ebay and you signed that away when you joined ebay. Gotcha.

- Status

- Not open for further replies.